A West African Project on ‘Closing the Investment gap in West Africa’s Energy Sector’

Background and Introduction

Achieving universal energy access in West Africa continues to remain a pressing need: a large fraction of the population is still yet to have access to electricity. West Africa needs an aggressive fund mobilization strategy different from what has been pursued till now, specifically one that produces a critical mass of bankable, investment-ready energy projects.

With tightening of budgets in countries that provide aids, financial aids cannot be looked upon as a long-term strategy in closing the region’s energy sector funding gap.

At present, public investment has been the primary source of financing for the region’s energy sector development. However, this is insufficient if the energy sector is to develop at the same pace as, and surpass, population growth in the region. With tightening of budgets in countries that provide aids, financial aids cannot be looked upon as a long-term strategy in closing the region’s energy sector funding gap. West African member states (and their financial institutions) must adopt innovative mechanisms to attract more private sectors financing. It is against this background that In partnership with the ECOWAS Bank for Investment and Development (EBID), PUTTRU is implementing a project entitled: Closing the Investment Gap in West Africa’s Energy Sector.

In partnership with the ECOWAS Bank for Investment and Development (EBID), PUTTRU is implementing a project entitled: Closing the Investment Gap in West Africa’s Energy Sector.

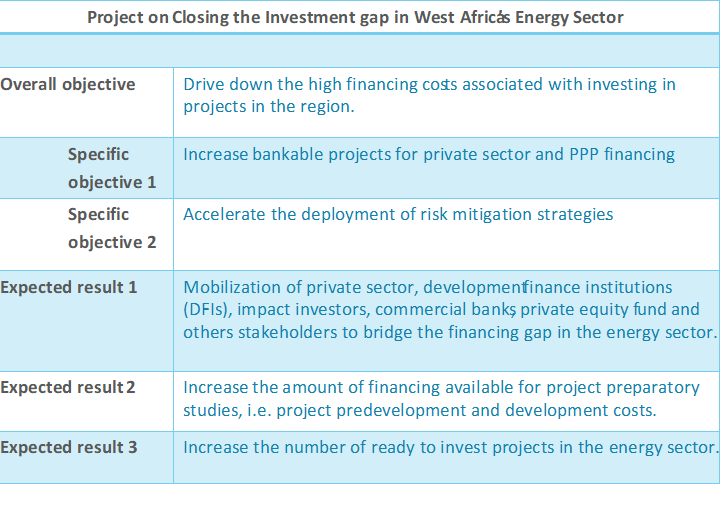

The regional project aims to reduce the high financing costs of investing in energy sector related ventures, through a combination of risk mitigation strategies and access to sophisticated financiers via our digital capital raising platform.

Project objectives

It is widely understood that until the energy sector is made safe for private sector investment, public finance will continue to play a key role in developing the sector.

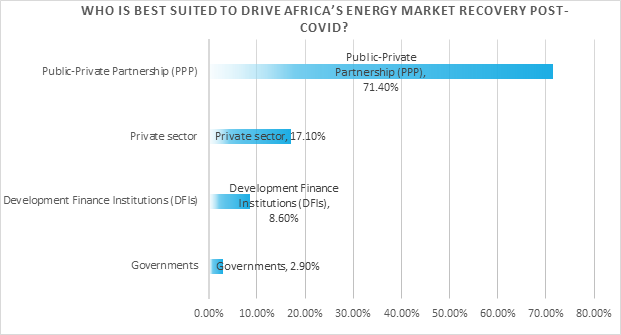

This concern came out strongly during the PUTTRU organized webinar on: Closing the US$ 50 billion per annum investment gap in Africa’s energy sector. Insights from the participants point to increased project finance opportunities, through private and public participation (PPP), being a primary area of interest for private sector actors wanting to invest in Africa’s energy market.

Equipped with this insight, this project aims to attract private investment into the West African energy market by accelerating deployment of risk mitigation strategies and, thus, drive down the high financing costs associated with investing in projects in the region. Ultimately, the project aims to lead to an increase of bankable projects for private sector and PPP financing.

Methodology

The methodology applied to this project are designed to achieve two goals:

- Increase private sector returns on investment

- Mitigate downside risks of private sector investment

To achieve the first goal, PUTTRU Digital Platform will create a pipeline of investment-ready energy projects, evident through the presentation of feasibility study reports. In addition, PUTTRU will assemble African energy companies that present strong corporate governance requirements, cash flow analysis, and have the track record to deliver the projects, either as a single business entity or part of a special purpose vehicle (SPV).

Concerning the second goal, through collaboration with key regional or continental (financial institutions), risks associated with negative events which may delay the project or hinder the project financiers from recuperating their investment will be addressed systemically. PUTTRU will therefore facilitate the participation of these institutions, for them to either participate in syndications, provide currency hedging, guarantees, or other incentives to enable private sector participation in energy projects.

How to participate in the project

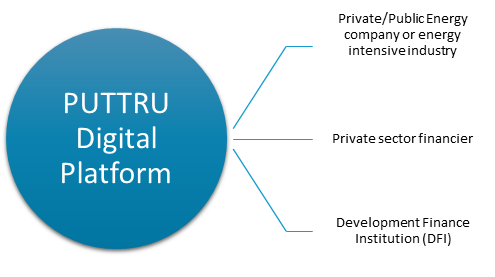

Whether you are an electric power producing company, an energy equipment manufacturing company (or energy intensive company interested in developing captive power projects), private sector financier or a DFI, the platform allows you to create your unique profile: detailing who you are and who you want to partner with.

- Our offline advisory services ensures that energy companies get the attention of financiers in the market for what they offer, in terms of requirements for debt or equity financing.

- Our intelligent algorithm ensures that both energy companies and financiers are optimally matched, increasing the likelihood of deals being closed.

- Our interactive virtual dealroom allows both parties to negotiate without pressure, ensuring that both parties walk away with deals that create and share value.

Contact us today for your free consultation

info@puttru.com

Executed by:

Implementing Partner: