Our achievements in 2020 and Priorities for 2021

Board of Directors Meeting, 3 February, 2021 (Virtual)

1. Recapping 2020

Energy finance remains a pressing need in Africa’s energy sector. It is for this reason that PUTTRU was established in the first place.

PUTTRU exist to facilitate and fast-track energy finance for African state-owned or privately-held energy companies. We accomplish this through a state-of-the-art digital platform that connects financiers, energy companies, transaction advisory services and others.

Through the functionalities of the platform, these parties are able to interact, negotiate, close and track investment deals electronically. Furthermore, our platform makes syndications possible, allowing several financiers to participate in a project. Read article on how to onboard the PUTTRU Digital Platform.

It is for this reason that 2020 remains a historical timeline for PUTTRU.

Going Live …

Despite the global chaos brought by Covid- 19, we started 2020 with one goal in mind: go live.

As a result, we spent the most part of the year testing of the platform – alpha and beta testing.

So, we invited real users from our customer segments: financiers, African energy companies and global energy companies. The beta testing phase ran for about two months.

Following the testers’ greenlight, on 29 October 2020 the digital platform was released during an international webinar. African energy ministers provided keynote statements. Moreover, the event drew over 250 registrants from five continents (Africa, Europe, America, Middle East and Asia) and 53 countries.

Furthermore, the launch event was televised by the Nigerian Television Authority (NTA) and broadcasted throughout the day. See more here: Our Digital Solution is Now Live!

Last year we finalized our partnership with the ECOWAS Bank for Investment and Development (EBID). This year, we have begun the work of creating a Ready-to-Invest pipeline for EBID’s financing.

2. Our achievements in 2020

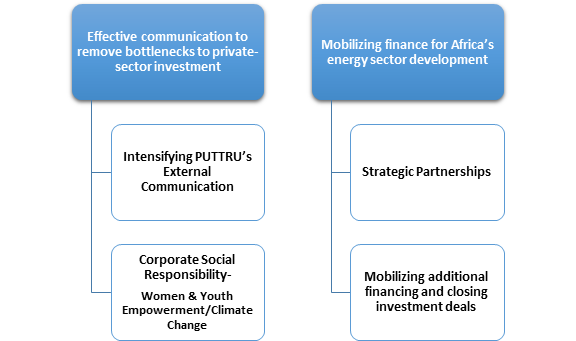

Prior to, and since our launch, PUTTRU works through two result areas, namely:

- Result Area1: Effective communication to remove bottlenecks to private-sector investment and,

- Result Area 2: Mobilizing finance for Africa’s energy sector development.

A. Effective communication to remove bottlenecks to private-sector investment

Our goal here is to improve communication between governments and the private sector. For this reason the webinar brought these actors together. For instance, we had representatives from an international bank, private equity fund and African energy company and African energy ministers.

Furthermore, it was clear from the discussions that the public and private sector want to collaborate more in energy finance.

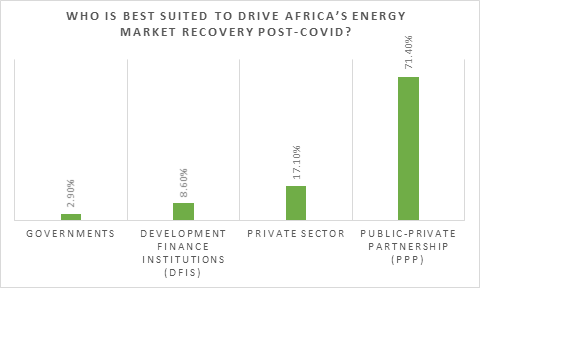

In addition, the same sentiments were felt by the participants. This is based on a poll conducted during the webinar. To illustrate, a far majority of respondents identified Public-Private-Partnerships (PPP) as the best suited option for Africa’s energy finance.

Figure 1: Webinar Poll Question

More on our communication

In the middle of 2020, we launched a videocast called Thought Leaders.

Through this program, voices shaping the energy industry in Africa share their in-depth knowledge with a broader audience. Specifically, the aim is to increase knowledge and information of a market that has been termed “difficult”.

Last year, we interviewed government officials, economists, financiers and business owners. In 2021, we will continue with this same trend and focus.

Watch our very first interview with Ope Onibokun.

Furthermore, we had kicked-off our Corporate Social Responsibility (CSR) activities targeting Youth Empowerment.

Tagged #Whatwouldyoudo challenge, we launched an Africa-wide social media campaign to give African youths a say in what 2030 should look like, as far as the energy situation in Africa is concerned. Five young men and women were awarded prize monies. This ranged from US$500, for the first winner and US$ 100 for the runners-up.

B. Mobilizing Energy Finance for Africa’s Development

PUTTRU has worked and continue to work in bringing together the key actors needed in the ecosystem. Namely, financiers, transaction advisors (advisory support specialists) and other financing enablers.

We have been active in setting up the structure for financiers to feel comfortable financing energy ventures in Africa

For example, last year we finalized our partnership with the ECOWAS Bank for Investment and Development (EBID). This year, we have been busy with creating a Ready-to-Invest pipeline for EBID’s financing.

Eligible projects must meet the following conditions:

- US$1.5 million for minimum;

- US$30 million for national public sector projects;

- US$45 million for regional public sectors projects;

- US$22.5 million for private sector projects.

For on-lending from local banks, the ticket size for minimum amount could go below US$ 1.5 million.

For more information: A West African Project on ‘Closing the Investment gap in West Africa’s Energy Sector’.

In 2021, our clients can expect more announcements of strategic partnerships for certain project-types, ticket-sizes and specific countries.

Supporting the Energy Finance Ecosystem

Furthermore, we have been active in setting up the structure for financiers to feel comfortable financing energy ventures. Another area of focus has been on providing free assessment tools to African energy companies.

PUTTRU developed a financing-readiness audit template that enables companies independently assess themselves. Following this assessment, companies are able to determine their state of preparedness to engage with financiers. Moreover, companies will be able to identify where they have gaps and how best to address them. The free template is available in English and French.

PUTTRU has developed a financing-readiness audit template to enable African Energy Companies conduct self assessments.

3. Lessons from 2020

- The gaps PUTTRU as a company aims to close are real and deeply felt by these energy sector actors.

- There is need to strengthen the company’s external communication efforts. This is necessary in order connect with other more actors and establish partnerships.

- There is need to educate people on how the digital platform works.

- A lot of technical assistance work is needed to get small-sized/early-stage energy companies ready for external financing.

4. Priorities for 2021

Meeting Energy Finance Goals through External Communication

PUTTRU recognizes the importance of increasing communication. Intensifying outreach and external communication efforts is on top of our to-do.

Therefore, special reports, webinars, press releases and others will be utilized. Moreover, country-level interactions will be intensified.

The success of the Thought Leaders series show that this is an area that audience are interested in. People can , therefore, expect more Thought Leaders interviews in 2021.

In addition, French and English will be the languages of communication.

Strategic Partnerships for Energy Finance

Establishing strategic partnerships are a core part of our operations. Especially, if we are to achieve our goal of making our business ecosystem efficient.

PUTTRU held and continues to organize meetings with potential strategic partners. The company is looking at increasing its partnership-building efforts.

Mobilizing Energy finance and closing investment deals

The geographical focus is the entire 55 countries of the African continent, although we are currently prioritizing sub-Saharan Africa. Thus, efforts will be made towards mobilizing energy finance for regions beyond the West Africa.

It is important to note that a sub-Saharan Africa strategy has been in place prior to now. During the launch of PUTTRU, the webinar was endorsed by the SADC Centre for Renewable Energy and Energy Efficiency (SACREEE), we had the minister of Zambia (represented) and the attendance of individuals from all over Africa.

Does any part of our priorities for 2021 speak to you? Write to us at: info[at]puttru.com